north carolina estate tax certification

Real Estate Checklist Tax. As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution.

Understanding North Carolina Inheritance Law Probate Advance

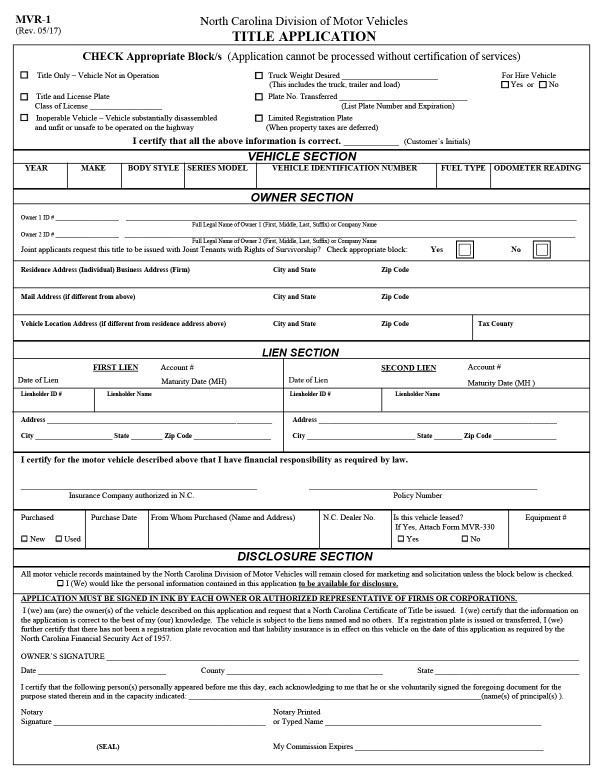

A form showing an estate tax certification for decedents dying on or after January 1 1999 in North Carolina is presented.

. Use this form for a decedent who died on or after 111999 but prior to 112013. AOC-E-207 Estate E Inheritance And Estate Tax Certification Files Inheritance And Estate Tax Certification PDF 245 KB These files may not be suitable for. An estate tax certification under GS.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited. Get An Estate Planning Form Using Our Simple Step-By-Step Process. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable.

For assistance or to acquire a. For a decedent who. Beneficiarys Share of North Carolina Income Adjustments and Credits.

I the personal representative in the above estate certify that. For a decedent who. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. Use this form for a decedent who died on or after 111999 but prior to 112013. NC K-1 Supplemental Schedule.

North Carolina Taxes- Current Update Feb 2022. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291.

Ad North Carolina Taxes Same Day. I counseled persons in estate planning including giving advice with respect. Owner or Beneficiarys Share of NC.

North Carolina law requires the Department of Revenue to provide a certification and continuing education program for county assessors and appraisers. In addition applicants must demonstrate involvement in specific estate planning activities as defined below. Tax Certification Alleghany County North Carolina Tax Certification NOTICE.

28A-21-2a1 is not required for a decedent who died on or after 112013. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. 28A-21-2a1 is not required for a decedent who died on or after 112013.

North CarolinaJul2012 p1. I the personal representativefiduciaryspouse in the above estate certify. High Point North Carolina Inheritance And Estate Tax Certification - Decedents Prior to 1-1-99 Prevent obstacles connected to the common need for trying to find legal samples online.

Estate Tax Certification For Decedents Dying On Or After 1199. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. A tax certification form must accompany ALL DEEDS to be recorded.

County Assessor and Appraiser Certification Table NCDOR. Ad Answer Simple Questions to Make An Estate Planning Form On Any Device In Minutes. A form showing application and.

Real Estate Checklist Tax. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of. An estate tax certification under GS.

Understanding North Carolina Inheritance Law Probate Advance

Non Income Producing Properties Nc Dncr

Vincent Allen Project Archives The Old House Life Old Things Updating House Old House

Eog Tips Laborales En Eog Estamos Conscientes De Que Nuestros Anos De Experiencia Y La Confianza De Nuestros Clien Tax Attorney Business Design Estate Lawyer

Inheritance Tax Here S Who Pays And In Which States Bankrate

North Carolina Is No 1 In America S Top States For Business 2022

Veterans Property Tax Relief Dmva

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions

United Arab Emirates Dubai 4k Wallpaper Dubai Real Estate Dubai Dubai Offers

All About Bills Of Sale In North Carolina The Forms Facts You Need

What Is A Small Estate Affidavit Hopler Wilms Hanna

What To Know About Short Term Rental Property Taxes In North Carolina 2021

North Carolina Issues Guidance On Pass Through Entity Tax Cherry Bekaert

7 Phases Of The Probate Process In North Carolina Carolina Family Estate Planning

North Carolina First Time Homebuyer Assistance Programs Bankrate

More Than 1 In 8 Oklahoma Children Live In A Home Where The Head Of The Household Doesn T Have A High S Counting For Kids Education Issues Health Care Coverage

My Real Estate Chat Paper Bag Walls Real Estate Tips Real Estate